BTC Price Prediction: Analyzing Investment Potential Amid Market Shifts

#BTC

- BTC is trading above its 20-day moving average, indicating bullish technical momentum.

- News sentiment is mixed but leans positive due to institutional interest and macroeconomic factors.

- Long-term predictions, such as tripling by 2030, support investment appeal, though short-term risks exist.

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

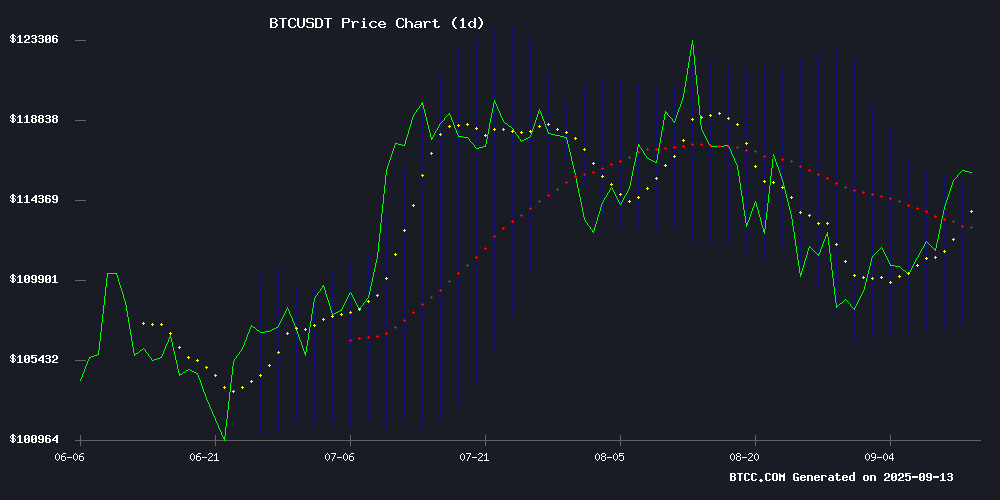

BTC is currently trading at $115,385.77, positioned above its 20-day moving average of $111,524.91, indicating underlying bullish momentum. The MACD reading of -862.30 suggests some near-term consolidation, though the price holding above the middle Bollinger Band at $111,524.91 supports continued upward potential. According to BTCC financial analyst Robert, 'The technical setup suggests BTC could test the upper Bollinger Band resistance at $115,925.62 if buying pressure sustains.'

Market Sentiment: Geopolitical Tensions and Institutional Interest Support BTC

Current news highlights Bitcoin's stability at $116K amid geopolitical tensions, while discussions about a potential U.S. strategic Bitcoin reserve in 2025 and corporate treasury shifts are fueling positive sentiment. However, warnings about phishing scams and miner revenue challenges introduce cautious notes. BTCC financial analyst Robert notes, 'The blend of institutional interest and macroeconomic factors creates a supportive environment, though short-term volatility from regulatory and security concerns remains a risk.'

Factors Influencing BTC's Price

Blockstream Warns of Phishing Scam Targeting Jade Hardware Wallet Users

Blockstream, a prominent infrastructure and hardware wallet provider, has issued a warning about a phishing email scam directed at users of its Jade hardware wallets. The company emphasized that it never distributes firmware via email, urging customers to exercise caution.

The alert underscores the persistent security challenges in the cryptocurrency sector, particularly for hardware wallet users who are often targeted by sophisticated phishing attempts. Blockstream's proactive communication reflects the industry's heightened focus on protecting user assets as adoption grows.

Bitcoin Holds Steady at $116K Amid Geopolitical Tensions

Bitcoin's price remained resilient at $116,000 despite escalating geopolitical rhetoric from former US President Donald Trump. The cryptocurrency market, often sensitive to macroeconomic shocks, showed no immediate reaction to Trump's calls for NATO nations to impose harsh sanctions on Russia and tariffs on China.

Trump asserted that the Russia-Ukraine conflict could end swiftly if NATO follows his directives, including an oil embargo against Russia and coordinated sanctions. He positioned these measures as necessary to weaken Russia's bargaining power and break China's influence over Moscow. "If NATO does as I say, the war will end quickly," TRUMP declared, framing the conflict as a consequence of current leadership rather than his own policies.

The market's muted response suggests crypto investors may be looking beyond short-term geopolitical noise. Bitcoin's stability contrasts with its historical volatility during similar geopolitical events, potentially signaling growing maturity in digital asset markets.

Digital Asset Stocks Diverge: Circle Rises as MicroStrategy Stalls Amid Market Shifts

The cryptocurrency market is witnessing a stark divergence between legacy players and emerging contenders. Research firm 10x Research highlights growing stress as compressed premiums disrupt previous growth dynamics, with liquidity shifts exacerbating the divide. Bitcoin's flat performance belies underlying volatility, suggesting potential for sharp rotations ahead.

MicroStrategy's dominance as a Bitcoin proxy is waning. Its NAV multiple collapsed from 1.75x to 1.24x between June and September, dragging shares down 18.5% to $326. The company's constrained purchasing power underscores fading institutional appetite for layered Bitcoin exposure. "Complexity is the enemy of returns," cautions investor Jason, echoing market skepticism toward indirect BTC plays.

Japan's Metaplanet cratered 66% on tax policy fears, demonstrating retail-driven instability despite trading at 1.5x NAV. In contrast, Circle's USDC scored a 19.6% rally since September 9 following its Finastra integration, showcasing how strategic partnerships can defy sector headwinds.

Fed Rate Cut 2025: Bitcoin Volatile While Gold and Stocks Rally

Markets are reacting divergently to the anticipation of the next Federal Reserve rate cut, with gold and equities rallying while bitcoin exhibits volatility. The interplay between traditional safe-haven assets and digital currencies underscores the evolving landscape of investor sentiment.

Gold's upward trajectory reflects its enduring appeal during periods of monetary policy uncertainty. Equities, meanwhile, continue their ascent as investors price in the potential for looser financial conditions. Cryptocurrencies, led by Bitcoin, remain caught in a tug-of-war between risk-on and risk-off impulses.

Corporate Crypto Treasuries Shift From 'Easy Money' to Competitive Execution

The era of passive Bitcoin accumulation as a corporate treasury strategy is ending. Public companies now hold over 1 million BTC ($110 billion) across 213 entities, with digital asset treasuries totaling $215 billion. MicroStrategy's pioneering 2020 model—rebranded as Strategy Inc.—has inspired imitators but faces mounting challenges.

Market-to-net-asset premiums have evaporated as Nasdaq tightens requirements and Strategy abandons its 2.5x stock sale threshold amid funding strains. The company reports $14.05 billion in unrealized BTC gains but faces class-action lawsuits, while competitors like MARA Holdings and Japan's Metaplanet pursue aggressive accumulation targets.

Analysts warn idle BTC holdings no longer ensure solvency as rising rates amplify negative carry. The landscape has shifted to a 'player-versus-player' phase where execution capability trumps scarcity premiums, according to Coinbase Research.

Why Alex Thorn Says the U.S. May Launch a Strategic Bitcoin Reserve in 2025

Alex Thorn, head of research at Galaxy Digital, suggests the U.S. government could announce a Strategic Bitcoin Reserve (SBR) by year-end. Markets are underestimating this potential move, which may signal institutional adoption of Bitcoin as a reserve asset.

The proposal aligns with growing recognition of Bitcoin's role in macroeconomic strategy. Such a reserve WOULD mark a watershed moment for cryptocurrency legitimacy, echoing historical shifts like the abandonment of the gold standard.

Bitcoin Predicted to Triple by 2030 Amid Fiat Debasement Concerns

Bitcoin's meteoric rise from obscurity to a $2.2 trillion market cap has cemented its place in global finance. Wall Street and policymakers now openly engage with the asset, signaling a shift from skepticism to adoption. The cryptocurrency’s fixed supply of 21 million coins contrasts sharply with the unchecked expansion of fiat currencies, particularly the U.S. dollar, which faces mounting debt and inflationary pressures.

A conservative projection places Bitcoin at $333,000 by 2030, implying a 25% annualized return. While this pales against its historical 61% yearly gains, the forecast underscores Bitcoin’s role as a hedge against monetary debasement. Scarcity remains its cardinal virtue—more dollars chasing fewer coins creates an asymmetric opportunity.

No investment is without risk, but the structural case for Bitcoin grows louder as traditional systems strain under debt burdens. The math is simple: finite supply meets infinite money printing.

US Explores Strategic Bitcoin Reserve as Global Interest Grows

The US Treasury is studying the feasibility of a Strategic Bitcoin Reserve (SBR) under a newly introduced bill, reigniting policy discussions that gained traction earlier this year. President Donald Trump's March executive order laid the groundwork for both an SBR and a Digital Asset Stockpile, though detailed implementation plans remain pending.

Alex Thorn, Galaxy Digital's head of research, predicts a formal SBR announcement by year-end—a timeline some market participants view as ambitious. Behind-the-scenes progress continues despite limited public updates, with administration officials confirming ongoing interest in the initiative.

International momentum builds as Kyrgyzstan advances its own crypto reserve legislation, following Bitcoin Indonesia's recent economic strategy talks with government officials. These developments signal growing institutional recognition of Bitcoin's strategic value at the national level.

Bitcoin Treasury Premium At Risk — What Could This Mean For BTC Price?

Bitcoin treasuries are grappling with a critical erosion of their market premium as volatility plummets and corporate buying slows. Monthly BTC acquisitions by these entities have collapsed 97% since November 2024, signaling extreme risk aversion.

The mNAV ratio—a key metric comparing share prices to underlying BTC holdings—faces pressure as annualized volatility hits multi-year lows. "Without price swings, treasuries lose their ability to monetize volatility and justify premiums," notes CryptoQuant's Julio Moreno. Strategy, the largest corporate holder, saw mNAV spikes above 2.0 during past volatility surges—a scenario becoming increasingly rare.

Bitcoin Miners Adapt to Rising Network Difficulty and Shrinking Revenue

Bitcoin miners are navigating stormy market conditions as network difficulty hits record highs and revenues decline. Representatives from Everminer, Bitdeer, and CleanSpark reveal strategies ranging from financial optimization to energy grid partnerships and expansion into new computing markets.

The network's difficulty surpassed 136 trillion this month, marking its fifth consecutive increase since June. Meanwhile, hashprice—a key revenue metric—has dropped to around $51, the lowest since June. This squeeze on profitability is exacerbated by September's historically weak Bitcoin price performance, contrasting sharply with August's stronger margins.

Miners now face mounting pressure to differentiate themselves through unique competitive strategies. The industry's instability stems from converging market pressures, requiring innovative approaches to stay afloat.

Bitcoiners Chasing Quick Gains Risk Wipeout, Warns Arthur Hayes

Bitcoin investors expecting overnight riches are setting themselves up for failure, according to BitMEX co-founder Arthur Hayes. His blunt assessment targets speculative traders treating BTC as a lottery ticket rather than a long-term asset.

"Buying Bitcoin today and demanding a Lamborghini tomorrow isn't how this works," Hayes remarked, criticizing the get-rich-quick mentality permeating retail crypto circles. The commentary surfaces as Bitcoin consolidates below all-time highs, testing the patience of momentum traders.

Is BTC a good investment?

Based on current technical and fundamental factors, BTC appears to be a favorable investment for those with a higher risk tolerance and long-term perspective. The price is above key moving averages, and growing institutional interest, such as potential U.S. strategic reserves and corporate adoption, supports upward momentum. However, investors should be aware of near-term volatility due to regulatory updates and market sentiment shifts.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $115,385.77 | Bullish above 20-day MA |

| 20-Day MA | $111,524.91 | Support level |

| Upper Bollinger Band | $115,925.62 | Near-term resistance |